Fast Take

Flows: Recent sessions show ETH ETF inflows outpacing BTC, signaling institutional rotation.

Structure: Price tagged prior breakout liquidity, holding a higher-low regime.

On-chain: Staking + L2 activity remain robust—usage didn’t break with price.

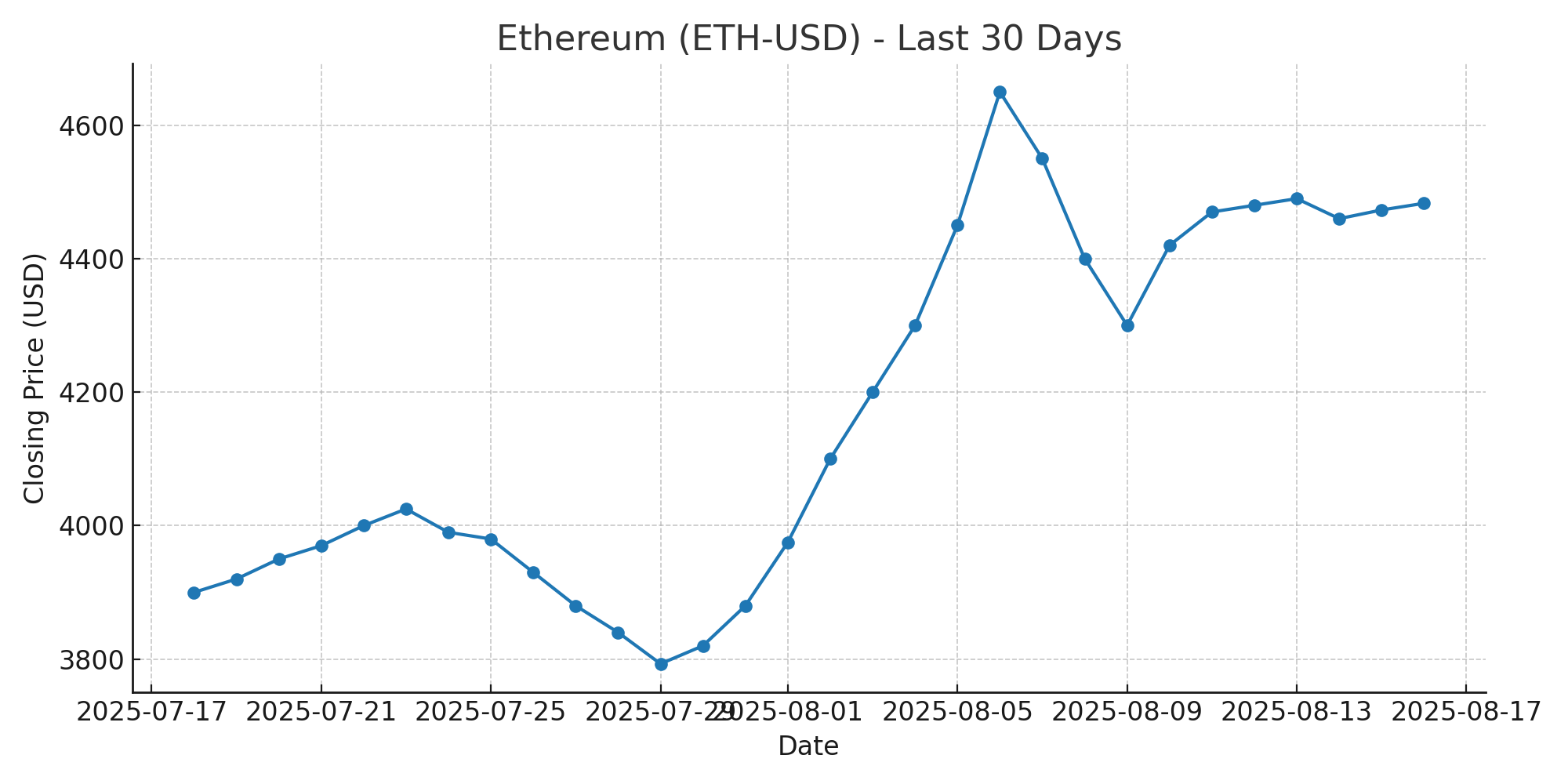

ETH Price — Last 30 Days (Yahoo Finance)

~10% one-day flush reset leverage and funding.

Recovered into a higher-low structure—trend still constructive.

Typical crypto pattern: shakeout → base → grind higher.

3-Month Outlook (Not Financial Advice)

- Base case: Range build then grind higher; buy red into support.

- Bull case: Flows accelerate → push through prior swing highs.

- Risk case: Macro/rules shock; invalidate below key shelf → reassess.

Disclaimer: Educational commentary only. Crypto is volatile; do your own research.